Estate Duty Planning Strategies are essential for South Africans to minimize inheritance tax (Estate Duty) and safeguard assets. By combining asset structuring, strategic gifting, insurance planning, and compliance with local laws, individuals can ensure a smooth wealth transfer process. Creating comprehensive will and trust structures, choosing the right investment vehicles, and appointing experienced Executors/Trustees are key steps. Regular reviews are vital to adapt to changing tax laws and family circumstances, ensuring efficient estate management and maximum asset preservation for future generations.

In South Africa, effective estate duty planning is crucial for ensuring your legacy is protected. This article offers 7 essential tips tailored to navigate the complexities of inheritance tax planning and create a robust legal framework. We’ll explore strategic techniques, from understanding estate duty rules to appointing trustees, enabling you to make informed decisions and mitigate potential tax burdens. By implementing these measures, individuals can secure their assets and ensure a smooth transfer process in accordance with South African laws.

- Understanding Estate Duty Planning Strategies in South Africa

- The Impact of Inheritance Tax on Your Estate

- Creating a Comprehensive Will and Trust Structure

- Utilizing Tax-Efficient Investment Vehicles

- Appointing Executors and Trustees: Ensuring Smooth Administration

- Regular Review and Updates for Changing Circumstances

Understanding Estate Duty Planning Strategies in South Africa

Estate Duty Planning Strategies are crucial for individuals and families looking to protect their assets and ensure a smooth transfer of wealth in South Africa. With a well-thought-out plan, you can minimize liabilities associated with inheritance tax planning, commonly known as Estate Duty. The key lies in understanding the various strategies available and tailoring them to your specific circumstances.

In SA, Estate Duty is levied on the value of an individual’s estate at the time of their death. By implementing proactive measures, such as asset structuring, gift giving, and insurance planning, individuals can legally reduce the taxable value of their estate. It’s important to consult with professionals who can guide you through these complex strategies, ensuring compliance with local laws while optimizing your financial future.

The Impact of Inheritance Tax on Your Estate

In South Africa, inheritance tax, formally known as Estate Duty, can significantly impact your estate planning efforts. Understanding how this tax works is crucial when developing effective Estate Duty Planning Strategies. The tax is levied on the value of an individual’s estate at the time of their death and can be a substantial financial burden for families if not properly managed.

One key aspect to consider is asset allocation and timing. Strategically distributing assets among beneficiaries, utilizing available exemptions, and planning transfers in advance can help minimize the inheritance tax liability. Additionally, South African laws offer various Inheritance Tax Planning in South Africa options, such as gift duty exemptions and delayed inheritance provisions, which can be leveraged to optimize tax efficiency while ensuring your wishes are carried out according to your estate plan.

Creating a Comprehensive Will and Trust Structure

In order to effectively manage your assets and ensure a smooth transition upon your passing, creating a comprehensive will and trust structure is paramount. This involves carefully considering how your estate will be distributed, minimising potential tax liabilities, and nominating guardians for minor children. A well-crafted will and trust can act as robust Estate Duty Planning Strategies in South Africa, helping to mitigate Inheritance Tax Planning challenges and securing your family’s financial future.

By combining wills, trusts, and other legal tools, you can create a tailored plan that reflects your unique circumstances and goals. This might include establishing different types of trusts for specific purposes, such as providing for dependents or preserving assets for future generations. Such strategic planning not only ensures your wishes are respected but also maximises the preservation and transfer of your wealth.

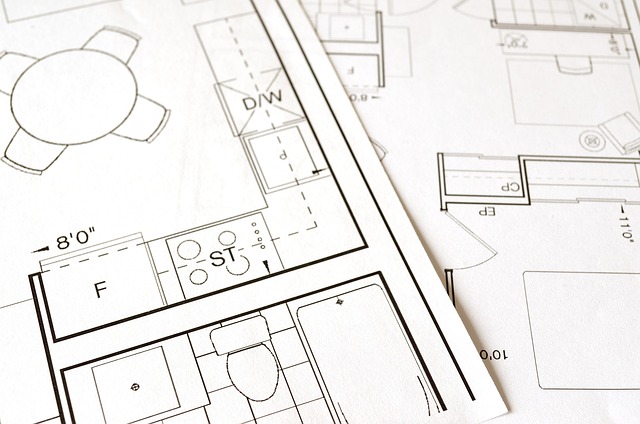

Utilizing Tax-Efficient Investment Vehicles

In South Africa, efficient estate duty planning is crucial to preserving wealth for future generations. One of the most effective strategies involves choosing the right investment vehicles that offer tax advantages. By leveraging tax-efficient investment options, individuals can significantly reduce their inheritance tax burden and overall estate duty liabilities. For instance, retirement funds and certain types of trusts are well-known Estate Duty Planning Strategies in SA, as they provide substantial savings on taxes. These vehicles allow for a more flexible distribution of assets while minimizing the impact of inheritance taxes, ensuring that your beneficiaries receive their share with minimal deductions.

When considering Inheritance Tax Planning in South Africa, it’s essential to consult with financial advisors who specialize in these matters. They can guide you through the complex landscape of tax laws and help structure your investments accordingly. By implementing these tax-saving measures, you can safeguard your estate, ensure a smoother transfer of assets, and potentially pass on more value to your intended heirs.

Appointing Executors and Trustees: Ensuring Smooth Administration

Appointing Executors and Trustees plays a crucial role in ensuring smooth administration of your estate duty planning strategies in South Africa. When choosing individuals to manage your assets, consider their experience, integrity, and ability to handle sensitive financial matters. It’s important to select people who are trusted by both you and your beneficiaries, as they will be responsible for distributing your assets according to your wishes, often while navigating complex inheritance tax planning considerations.

In terms of Estate Duty Planning Strategies in SA, having competent Executors and Trustees in place can significantly reduce potential disputes and delays during the administration process. They should have a thorough understanding of local laws, including inheritance tax planning requirements, to ensure your estate is managed efficiently and in compliance with regulations. This expert guidance is vital for maintaining the integrity of your wishes and ensuring your beneficiaries receive their rightful inheritances without unnecessary complications.

Regular Review and Updates for Changing Circumstances

In the dynamic landscape of asset management and inheritance tax planning in South Africa, staying proactive is key. One of the seven essential tips for trust planning involves implementing regular review and updates to your estate duty planning strategies. Life is unpredictable, and circumstances change – whether it’s a shift in family dynamics, new legal requirements, or alterations in financial goals. Therefore, it’s vital to periodically reassess your trust and related documents to ensure they remain fit for purpose.

Regular reviews enable you to make necessary adjustments to reflect these changes, minimizing potential disruptions during what could be emotional and complex periods. Staying current with inheritance tax planning strategies in SA also helps to maximize the transferability of assets while minimizing any associated taxes or legal complications.

In conclusion, effective trust planning in South Africa involves a strategic approach to Estate Duty and Inheritance Tax. By understanding the impact of these taxes and implementing tailored strategies, individuals can safeguard their assets and ensure a smooth transition for future generations. The seven essential tips outlined in this article serve as a roadmap to creating a robust legal framework, empowering you to make informed decisions and maintain control over your estate’s legacy.