In South Africa, effective Inheritance Tax Planning is crucial for a smooth transfer of assets upon death, balancing individual rights with tax revenue generation. Strategies include leveraging exemptions (e.g., R20 million personal exemption in 2023), establishing trusts for flexible estate management, and consulting legal/financial experts for personalized planning aligned with local taxation laws. Proactive measures like detailed wills, life insurance, and thoughtful gift-giving minimize tax obligations, ensuring a seamless asset transfer while protecting loved ones from financial strain. Staying updated on legislative changes is vital to optimize inheritance tax planning in South Africa.

In South Africa, inheritance tax planning is a crucial aspect of ensuring your estate’s longevity. This article provides five essential tips to reduce liability for you and your loved ones. We’ll explore strategies to minimize the impact of taxes, utilizing legal tools and structures tailored to SA’s unique regulations. By understanding exemptions, deductions, and staying updated with the law, you can make informed decisions to protect your assets.

- Understanding Inheritance Tax Planning in South Africa: A Brief Overview

- Strategies to Minimize Liability for Your Estate

- Utilizing Legal Tools and Structures for Effective Planning

- Maximizing Exemptions and Deductions: What You Need to Know

- Regular Review and Update: Adapting to Changes in the Law

Understanding Inheritance Tax Planning in South Africa: A Brief Overview

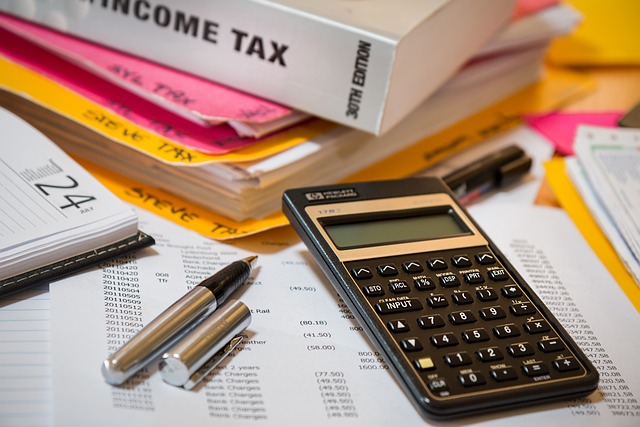

In South Africa, Inheritance Tax Planning is a critical aspect of ensuring a smooth transfer of assets upon your passing. The country has specific laws and regulations in place to govern this process, aiming to balance the rights of individuals with the need to generate revenue. Understanding these laws is essential for anyone looking to mitigate potential tax liabilities associated with inheritance.

The Inheritance Tax Planning in South Africa involves considering various strategies to minimize the tax burden on beneficiaries. This includes making use of available exemptions and allowances, such as the personal exemption amount, which currently stands at R20 million (as of 2023). Well-structured estate planning can also involve setting up trusts, which offer flexibility and potential tax advantages. By consulting with legal and financial professionals, individuals can create tailored plans to meet their unique circumstances while adhering to South African taxation laws.

Strategies to Minimize Liability for Your Estate

Minimizing liability for your estate is a crucial aspect of comprehensive financial planning, particularly in navigating the complex landscape of inheritance tax in South Africa. One effective strategy involves utilizing various legal tools and structures to optimize the distribution of assets while minimizing tax obligations. Estate planning experts recommend drafting a detailed will that outlines clear instructions for asset dispersal, ensuring that your wishes are respected and potential disputes are mitigated.

Additionally, establishing trusts can be a powerful method to protect assets and manage inheritance tax efficiently. By setting up trusts, you can control how and when assets are distributed, potentially reducing the taxable estate. Inheritance Tax Planning in South Africa often involves taking advantage of available exemptions and allowances, as well as employing strategies like life insurance planning and gift-giving within applicable limits. These proactive measures can significantly lessen the financial burden on your loved ones and ensure a smoother transfer of your estate.

Utilizing Legal Tools and Structures for Effective Planning

In South Africa, effective inheritance tax planning is crucial for individuals looking to protect their assets and ensure a smooth transfer of wealth to beneficiaries. Legal tools and structures play a pivotal role in this process, offering various options to mitigate liability and optimize tax efficiency. One such tool is trusts, which provide a legal framework for holding and managing assets, enabling grantors to maintain control while also protecting them from potential creditors or future tax assessments.

By utilizing trust structures, individuals can implement inheritance tax planning strategies tailored to their specific needs. This may include setting up revocable or irrevocable trusts, each with its own advantages in terms of asset protection and taxation. Additionally, professional advice on will drafting and estate planning is invaluable. Attorneys specializing in these areas can guide clients through the intricacies of South African inheritance tax laws, ensuring that legal documents are robust, compliant, and designed to minimize potential liabilities.

Maximizing Exemptions and Deductions: What You Need to Know

Maximizing exemptions and deductions is a strategic move for anyone looking to reduce liability, particularly when it comes to inheritance tax planning in South Africa. Understanding what assets qualify for these benefits can significantly impact your overall tax burden. For example, South Africa offers various exemptions for certain types of property, investments, and insurance policies. By structuring your affairs to take advantage of these exemptions, you can minimize the amount subject to taxation upon your passing.

It’s crucial to consult with a financial advisor or tax professional who can guide you through the complex rules and regulations. They can help ensure that your inheritance tax planning is not only compliant but also optimized to protect your estate. Additionally, staying informed about any changes in legislation related to exemptions and deductions will enable you to make informed decisions that could result in substantial savings for your beneficiaries.

Regular Review and Update: Adapting to Changes in the Law

Staying ahead of legal changes is a crucial aspect of liability reduction, especially when it comes to inheritance tax planning in South Africa. The legislation surrounding taxes and estates can evolve, introducing new rules and thresholds that impact your financial strategy. Regularly reviewing and updating your plans ensures you remain compliant and makes use of any favorable amendments. This proactive approach allows you to adapt to the changing landscape while minimizing potential penalties or surprises when transferring assets or planning for inheritance.

By conducting periodic assessments, you can identify outdated provisions in your will or trust that might lead to unintended consequences. Stay informed about modifications to inheritance tax laws and adjust your plans accordingly. A dynamic strategy that reflects current legislation ensures your family’s interests are protected while optimizing the distribution of your estate.

In navigating the complexities of inheritance tax planning in South Africa, a proactive approach is key. By implementing these 5 essential tips – understanding the system, minimizing liability through strategic estate planning, utilizing legal tools and structures, maximizing exemptions and deductions, and regularly reviewing your plan – you can significantly reduce potential risks. Stay informed and adapt to changes in the law to ensure your assets are protected for future generations.